Developing Micro-Credentialing Plan

Five steps to determine which short-term micro-credential you should be offering:

1. Look at employer and industry needs in your region.

While online means you can receive your certificate anywhere, students still prefer and more often select a location close to home. That means your local employment needs directly impact demand. Specific skills of high need are the places to start your search.

2. Assess competitors in your region offering similar short-term credentials – consider non-higher-ed competitors as well as their price point.

The competition is stiff, and similar to the change to offering more fully online programs, your institution needs to enter the short-term credential market and learn how to compete.

3. Evaluate special business partnerships you already have to uncover needs.

Employers are looking for more ways to train their workforce but also shifting benefits from office perks to growth and training. A partnership can provide a faster and lower-cost alternative to enrolling students.

4. Involve tenured faculty who can switch to developing and teaching certificates.

With the demand shifts, tenured faculty with only a few students in their programs is not uncommon. This can create a complicated situation, and one of the most successful solutions is evaluating how this faculty group can launch micro-certificates.

5. Evaluate how the short-term credential can be stacked to a for-credit degree.

The short-term credential may open the doors to students who had not considered you before and provide a new recruitment pipeline.

2022 Demand Forecast

Using Stamats’ analysis of the IPEDS Degree Completion Database, we would like to share insights and suggestions for your short-term certificate plan.

Business Disciplines

Business undergraduate certificates are the third-largest undergraduate certificate discipline in the USA; what do you offer?

- The number of undergraduate certificate awards in Business (CIP 52) grew to 104,708 in 2020 (+0.5% year-on-year growth).

Specifically in Business disciplines, the following subjects or skill sets posted larger volumes in undergraduate certificates:

- Accounting

- Financial Planning

- Operations Management

- Entrepreneurship

- Human Resources

Stand out from competitors by highlighting that your institution teaches to the industry standards or association standards, such as SHRM HR-Certified Professional or Certified Financial Planner.

Computer and Information Sciences and Support Services

- CIP Discipline 11 is the 7th largest undergraduate certificate discipline in the US.

- Number of awards grew +4.7% to 46,204 awards in 2020.

- This is where cybersecurity, networking, and specialized IT certifications come into play. CompTIA, Amazon Web Services and CISSP certificates are in demand by employers.

- Many credit and non-credit options are available to students—don’t overlook non-higher ed providers in this realm when doing your competitive analysis.

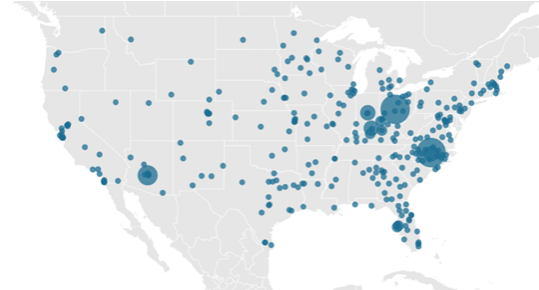

- The following map shows institutions reporting distance format undergraduate certificates in CIP code 11. The largest two providers in the country are not 2-year institutions:

- MyComputerCareer.edu with 8 locations and online delivery conferred over 3,800 CIP 11 undergraduate certificates in 2020.

- University of Phoenix – 1,057 CIP 11 certificates awarded in 2020.

Institutions conferring computer and information science undergraduate certificates in the distance format.

Big Data or Data Analytics

Management Sciences and Quantitative Methods (CIP 52.13) Post-baccalaureate certificates grew from 969 to 1,220, representing +33.4% in year-on-year growth (2019-2020). Some institutions are reporting their data analytics and big data certificates here.

Data analysis and analytics skills are needed in a wide variety of occupations. Hopefully, your institution has a plan to prepare students from many disciplines in this area.

Education

Special Education Post-Baccalaureate certificates (CIP 13.10) grew from 1,680 to 2,229 certificates, representing +32.7% in year-on-year growth from 2019-2020.

Most K-12 school districts are always on the hunt for teachers with special education skills. State teacher requirements differ greatly; some states require more education than a PB certificate.

Curriculum & Instruction Post-master’s certificates (CIP 13.03) grew from 912 to 1,061 (+16%) from 2019-2020. Additional education at the master’s level may help licensed teachers increase their salary or career options. Again, state requirements for master-level education will differ, so pay attention to what your state department of education issues for salary differentials.

Nursing

Registered Nursing Post Master’s certificates (CIP 51.38) jumped 17% from 2,584 to 3,032 from 2019-2020. These certificates represent many specialties outside of Administration/Nurse Leadership. The Stamats research team can provide more detailed information on graduate nursing trends. As healthcare jobs become more specialized, your nursing programs may need to adjust to specialized fields of study in nurse practitioners.

Law/Legal Affairs

Legal Research and Advanced Professional Studies Post-master’s certificates (CIP 22.02) grew from 352 to 472 (34%) from 2019-2020. Certificates and Master of Legal Studies for non-JD professionals are a growing trend. A wide range of legal areas is covered by these programs, such as Labor Law, Business/Finance/Tax Law, Health/Healthcare Compliance, Environmental Law, Intellectual Property, and Cybersecurity. Regulatory compliance is followed by various professions outside of law, so the need for additional training in specific areas of the law has increased.

Source: IPEDS Degree Completions 2020 (most recent data available).

Have a program you want to investigate? Ask our research team to help! We have access to student demand trends, labor data, and competitor trends.

Ready to Get Started?

Reach out to us to talk about your strategy and goals.